Ever wonder why some drivers pay pennies for insurance while others get crushed by bills they didn’t see coming? Most people ask, “what is PLPD insurance?” and assume any plan keeps them safe but that’s not always true. In Michigan, for example, a basic PLPD plan costs just $82–$133 per month, yet it leaves thousands of dollars of risk dangling over your head if something goes wrong. Insurance experts warn that state minimum coverage often isn’t nearly enough to cover a serious accident, yet millions of drivers still rely on PLPD.

Here’s the twist, what seems like the cheapest, most legal way to drive could quietly expose you to financial disaster. You’re about to discover exactly what is PLPD insurance, what it covers, and what it absolutely doesn’t.

Instant Answer:

PLPD insurance only covers other people’s injuries and property damage, it never pays for your car or medical bills. While it meets state minimums, a serious accident can leave you personally liable for tens of thousands, so relying on it alone is risky.

What is PLPD Insurance? A Simple Definition

PLPD stands for Personal Liability and Property Damage insurance. Many drivers wonder what is PLPD insurance, but it’s not a special product just another name for the liability coverage required by law. Michigan drivers hear the term most often, but it’s the same as liability-only insurance nationwide.

Bold Answer: PLPD insurance covers other people’s injuries and property damage when you cause an accident. It never pays for your own medical bills or vehicle repairs.

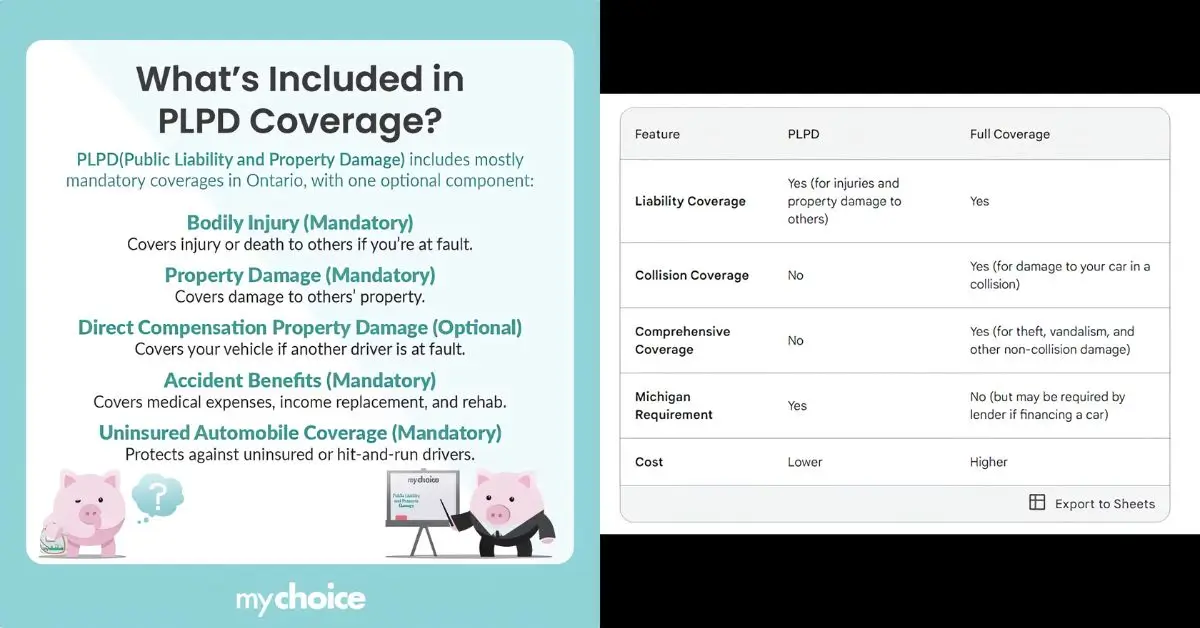

PLPD Means Two Things:

- Bodily Injury Liability: pays for the other person’s medical expenses when you’re at fault.

- Property Damage Liability: pays for damage you cause to cars, fences, or buildings.

The Big Limitation

Truth is, PLPD only protects others, never you. If your car gets wrecked, or you get hurt, those costs are on you.

(Visual idea: Split infographic showing “Covers Others” vs. “Doesn’t Cover You”)

What Does PLPD Insurance Cover? (And What It Doesn’t)

The line between covered and not covered is sharper than most people realize. Many first-time drivers ask, “what is PLPD insurance coverage exactly?”

Covered by PLPD:

- The other driver’s medical bills (up to your limits)

- Repair or replacement of the other person’s car or property

- Your legal defense costs if you’re sued

Not Covered by PLPD:

- Your vehicle repairs (requires Collision)

- Your medical bills (requires PIP or MedPay)

- Theft, vandalism, fire, or storm damage (requires Comprehensive)

- Accidents with uninsured drivers (requires Uninsured Motorist)

Quick takeaway: PLPD is protection for others. To protect yourself, you need more coverage.

The Real Cost of PLPD: Premiums vs. Risk

PLPD looks cheap on paper but that’s only half the story.

- In Michigan, PLPD costs $82–$133 per month on average (LAInsurance.com, 2023).

- Nationwide, minimum coverage averages about $635 per year for good drivers (AutoInsurance.com, 2025).

That’s why budget-conscious owners and rural drivers often lean toward it.

The Danger of Minimum Limits

Most states use 25/50/25 minimums ($25K per person, $50K per accident, $25K property damage). Sounds fine—until you realize a single hospital stay can exceed $50K.

As one Pennsylvania insurance expert warns: “State minimums don’t protect you from lawsuits if damages go beyond your limits.”

Myth vs Fact

- Myth: State minimum coverage is enough.

Fact: It’s often exhausted instantly in serious crashes. - Myth: PLPD is the cheapest overall choice.

Fact: Being underinsured can bankrupt you after one accident.

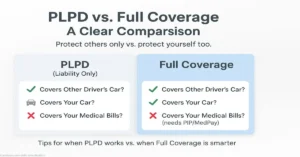

PLPD vs. Full Coverage: A Clear Comparison

This choice isn’t “cheap vs. expensive.” It’s more like “protect others only” vs. “protect yourself too.”

| Coverage Type | Covers Other Driver’s Car? | Covers Your Car? | Covers Your Medical Bills? |

| PLPD (Liability Only) | Yes | No | No |

| Full Coverage | Yes | Yes | No (needs PIP/MedPay) |

When PLPD Might Work:

- Your car is old and not worth fixing.

- You have savings to cover your own risks.

When Full Coverage is Smarter:

- You rely on your car daily.

- You couldn’t afford repairs out of pocket.

- You’re a new or high-risk driver who can’t risk gaps.

(Visual idea: Side-by-side comparison chart “PLPD vs Full Coverage”)

Is PLPD Insurance Right For You? A Buyer’s Checklist

Here’s a quick test to decide:

- Value Your Vehicle: Is your car worth less than 10× the annual cost of full coverage? If yes, PLPD may make sense.

- Check Your Assets: Do you own a home or savings? If yes, you’re at bigger risk if sued.

- Review Your Risk: Drive in traffic-heavy areas? Commute long hours? Higher accident chance means higher exposure.

- Know State Laws: Some states (like Michigan) add mandatory extras like PIP, making “PLPD” different in practice.

Bottom line: PLPD works only if you can self-insure the risk. Otherwise, it’s a false economy.

Sources:

- Policygenius: What Is PLPD Insurance?

- Nationwide: What is Personal Liability Insurance?

- Insure on the Spot: What Is PLPD Insurance and What Does It Cover?

- PLPD.com: What is PLPD Insurance?

- Progressive: What Is Personal Liability Insurance Coverage?

FAQ’s

Is PLPD insurance full coverage?

No. PLPD is liability-only insurance. Full coverage adds collision and comprehensive for your own car.

Can I drive legally with just PLPD?

Yes, in every state except New Hampshire (which has alternatives). It meets minimum legal requirements.

What is the average cost of PLPD in Michigan?

Drivers pay about $82–$133 per month, the highest in the nation.

Does PLPD cover me if a friend crashes my car?

Yes, liability usually follows the car, not the driver. Your policy pays for damage they cause to others.

Is PLPD good for new drivers?

Usually no. New drivers are higher risk and PLPD leaves them without coverage for their own vehicle.

What happens if damages exceed my PLPD limits?

You’re personally liable. That can mean lawsuits, wage garnishment, or asset seizure.

Author Bio

Jason Reeve is an Independent Auto Insurance Researcher with 9 years of experience helping drivers compare coverage options. He specializes in simplifying complex insurance terms into clear, practical advice.