Ever typed “what is personal lines insurance” into Google and felt buried under jargon? You’re not alone. Whether you’re a young adult buying your first car policy, a homeowner protecting your biggest investment, or a family stretching every dollar for peace of mind, the struggle is the same, you want clear, affordable coverage without the confusion.

The truth is, personal lines insurance isn’t just paperwork. It’s your safety net when life takes an unexpected turn, from fender benders to house fires. Let’s break it down in plain English, so you know exactly what’s worth your money and what’s not.

Quick Answer

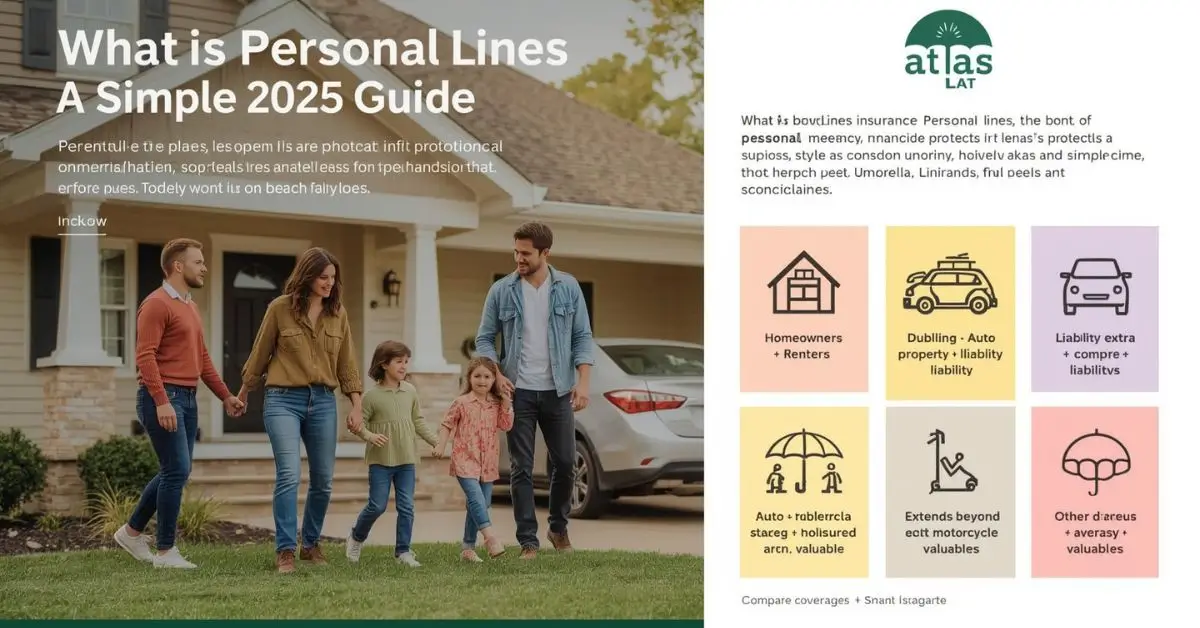

Personal lines insurance is coverage that protects individuals and families like auto, home, renters, and umbrella policies against everyday risks. It’s different from commercial insurance, which is designed for businesses.

Why Personal Lines Insurance Matters Right Now

If you’re buying your first policy, protecting your home, or raising a family, insurance can feel like a maze of confusing terms. You want peace of mind, not paperwork headaches. That’s where personal lines coverage comes in it’s insurance tailored to protect your life, not your business. From your car to your home to liability risks, personal lines insurance helps you stay financially secure when life throws curveballs.

What Is Personal Lines Insurance in Simple Terms?

So, what is personal lines insurance in everyday language? It’s any type of insurance meant for individuals and families not businesses. Think of it as your personal financial safety net. If your car gets wrecked, your house catches fire, or someone slips on your sidewalk, personal lines coverage helps pay the costs.

Common Types of Personal Lines Insurance

Here are the most common examples of personal lines insurance you’ll likely encounter:

- Auto insurance basics → Covers your car in case of accidents, theft, or damage.

- Homeowners insurance policy → Protects your house and belongings from fire, storms, or theft.

- Renters insurance definition → A budget-friendly way to protect personal property if you rent.

- Umbrella insurance explained → Adds extra liability protection beyond auto or home coverage.

- Personal risk insurance → Includes liability coverage that protects you if someone sues.

Difference Between Personal and Business Insurance

One big source of confusion for small business owners is whether they need personal or commercial coverage.

| Category | Personal Lines Insurance | Commercial Insurance |

| Who it covers | Individuals, families | Businesses, employees |

| Examples | Auto, renters, homeowners, umbrella | General liability, workers’ comp, commercial auto |

| Purpose | Protects your assets and lifestyle | Protects business operations and risks |

If you’re running a business even from home you’ll usually need both, since personal policies don’t cover business losses.

How Personal Lines Insurance Works in Real Life

Here’s how it plays out:

- Car accident → Your auto policy pays for damage and liability.

- House fire → Homeowners insurance covers repairs and replacements.

- Slip-and-fall lawsuit → Liability coverage shields you from high legal costs.

- Extra protection → Umbrella coverage kicks in when standard limits run out.\

This balance of protection keeps your financial future intact, whether you’re just starting out or raising kids.

Is Car Insurance a Personal Line of Insurance?

Yes. Car insurance is one of the most common forms of personal lines coverage because most states require it by law.

Do I Need Personal Lines Insurance If I Rent?

Absolutely. Renters insurance is affordable (often under $20/month) and covers your stuff against fire, theft, or water damage even if your landlord’s building policy doesn’t.

Why Is Personal Lines Insurance Important for Financial Security?

Without insurance, one accident could drain your savings. With it, you turn unpredictable risks into manageable expenses. That’s why middle-income families and young professionals rely on it as part of long-term financial planning.

Expert Insights

- The National Association of Insurance Commissioners (NAIC.org) stresses the importance of personal lines for managing risk in daily life.

- According to Investopedia, personal lines insurance forms the foundation of individual financial security.

- A U.S. Department of Treasury report highlights that personal lines remain the largest insurance sector by policy volume in the U.S.

Final Takeaway

Still wondering “what is personal lines insurance” in practical terms? It isn’t just about policies, it’s about peace of mind. Whether you’re a 25-year-old buying your first auto policy, a homeowner looking to protect your biggest asset, or a family balancing budgets and risks, personal lines coverage makes sure life’s “what-ifs” don’t derail your future.

FAQ’s

What types of policies are considered personal lines insurance?

Auto, renters, homeowners, condo, umbrella, and liability insurance all qualify.

What’s the difference between personal liability and personal lines insurance?

Personal lines cover a broad set of policies; liability is just one type of coverage within that set.

Can I buy personal lines insurance online?

Yes, many carriers now offer fast online quotes and purchase options, though it’s wise to compare coverage.

What are common exclusions in personal lines insurance?

Most policies don’t cover intentional damage, wear and tear, or business-related losses. Flood and earthquake coverage are usually sold separately.

What are examples of personal lines insurance policies for families?

Typical examples include auto, homeowners, renters, umbrella, and even personal liability policies tailored to family needs.

How does personal lines insurance protect homeowners?

It pays for repairs if your home is damaged, covers stolen items, and provides liability protection if someone gets hurt on your property.

Cheapest personal lines insurance policies for young adults?

Renters insurance and basic auto insurance are often the most affordable entry-level options.

Author Bio

Written by Sarah Klein is a financial content writer with 7+ years of experience simplifying complex topics like insurance and personal finance. She holds a B.A. in Communications and has worked with multiple fintech and insurance brands.